Subscription business– The business model that started off with Newspapers and magazines in 1600 has now become the most adopted one.

This trending subscription business model in the 21st century is likely to become the future of business just like Tien Tzuo said :

Though subscription business could rule out other business models, there is a biggest challenge for merchants who are in it.

The real challenge

The revenue of subscription business is 100% dependent on the recurring payments from the subscribers. When these recurring payments are unregulated and are left unmonitored, there could easily be payment defaults leading to a major setback in business eventually.

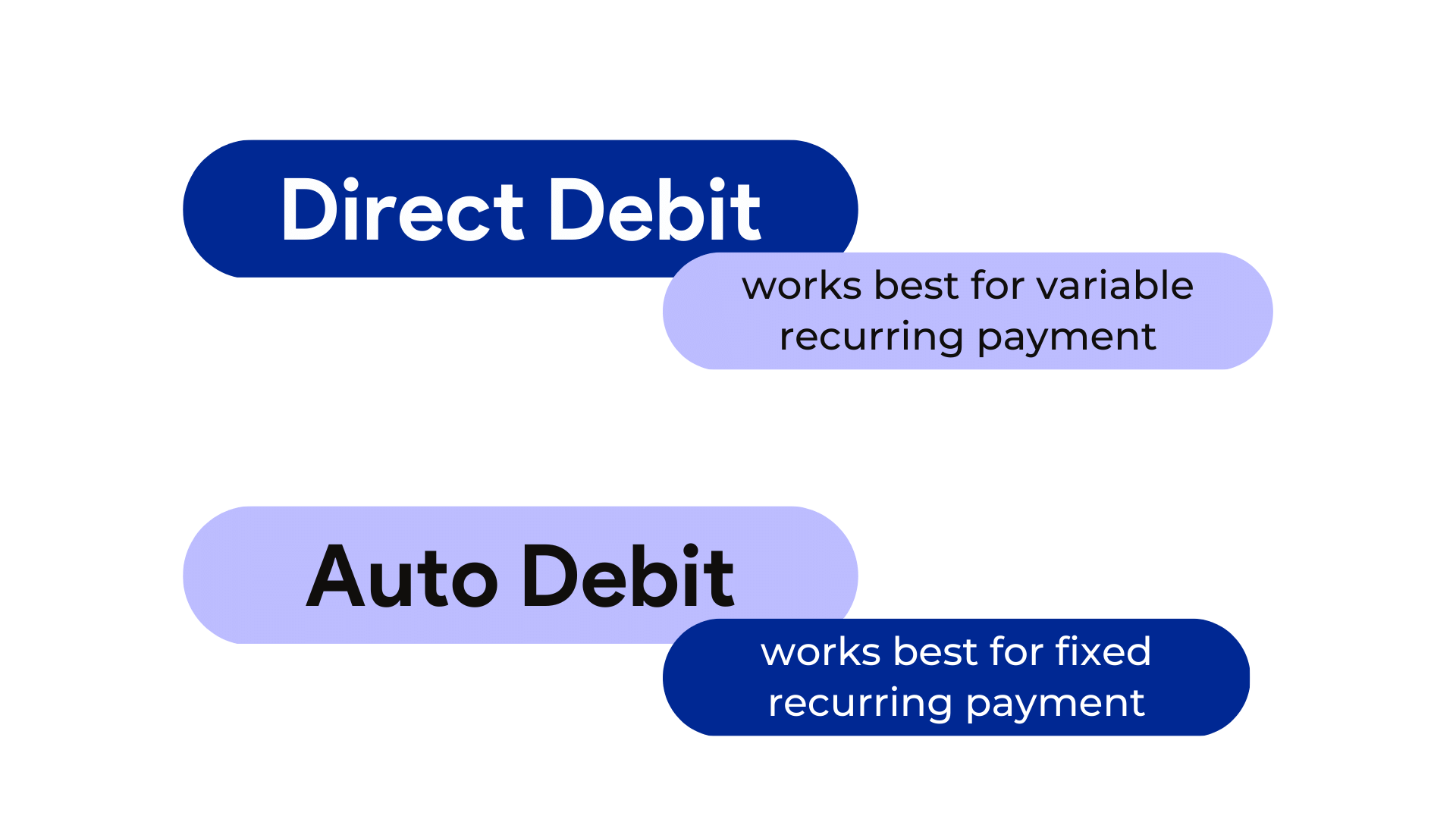

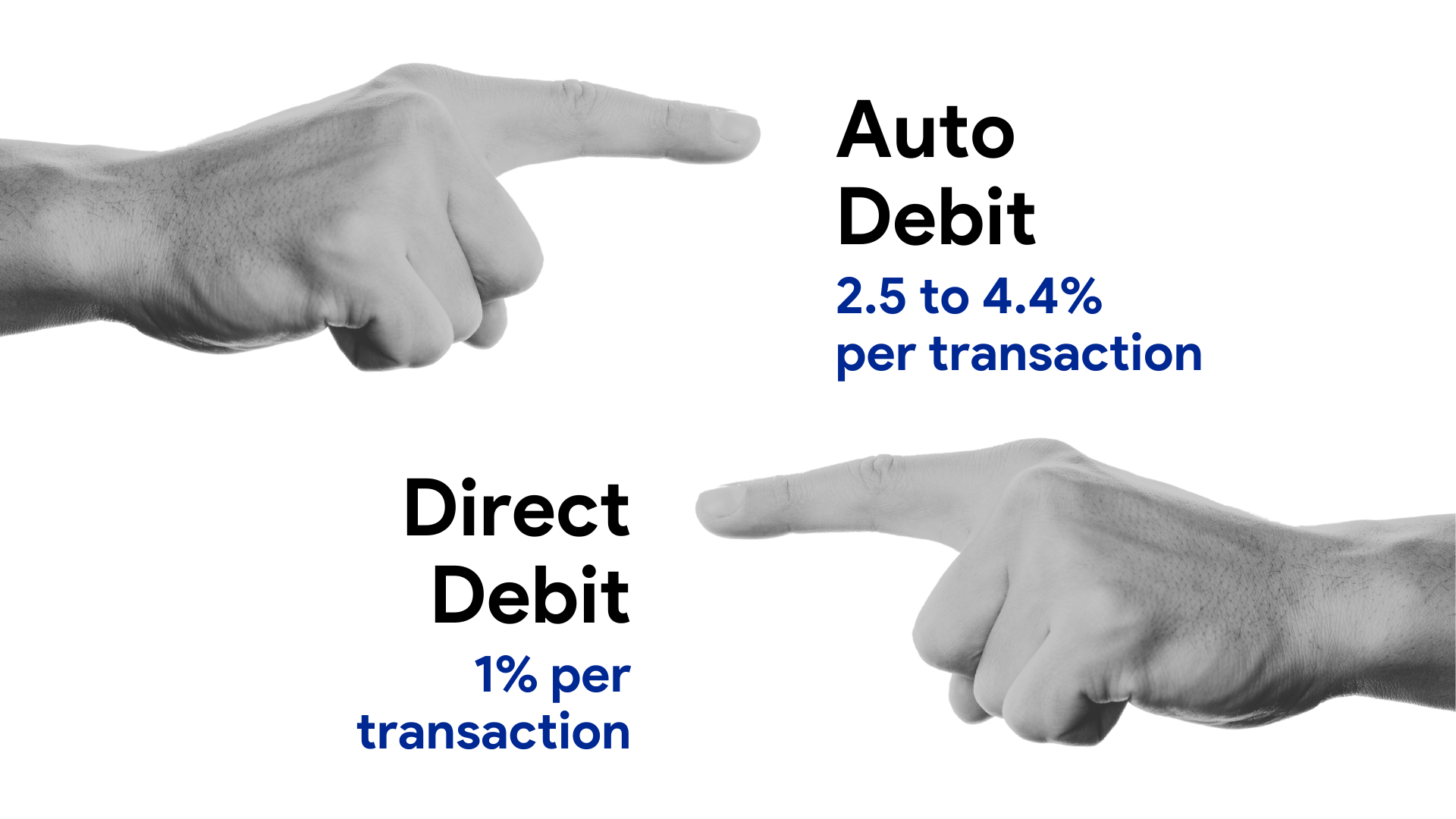

So, is the revenue at risk when the merchants shift to subscription business? Not really, provided they play it smart in terms of “payment collection”. The real challenge lies in collecting recurring payments without fail.

If you are a merchant who is into subscription business and if you are still wondering how to deal with payment collection, here are some tips for you,

Related Posts