Subscription-based businesses are becoming more popular than ever. Many businesses that formerly employed the pay-once are now transitioning to the subscription business model. This is due to the numerous benefits of invoicing clients on a recurrent basis. This enables the business to provide more engaging experiences to your clients across the whole buying and paying cycle, resulting in increased customer retention and, as a result, recurrent revenue growth.

According to a report from UBS, subscription business models could grow from a $650 billion market to a $1.5 trillion market between 2020 and 2025. Especially in Malaysia, this model has seen wide acceptance and recognition. Many local businesses, ranging from tiny to huge corporations, currently employ the subscription model. This model is being used in varied types of industries like entertainment, education, and e-commerce. Read on to know more about the subscription business model and its benefits.

What is Subscription Business Model?

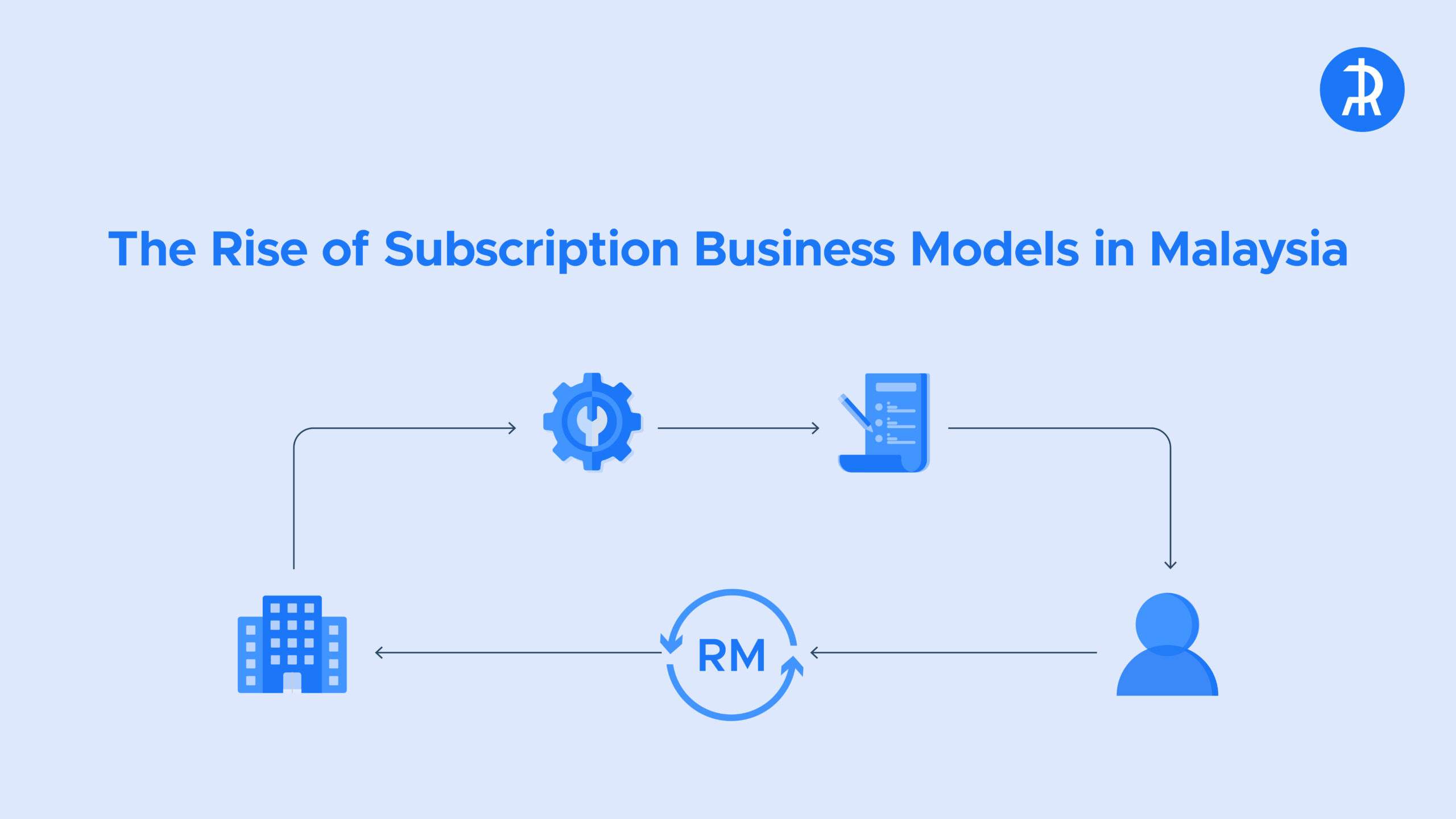

A subscription business model is a recurring income strategy in which clients pay a weekly, monthly, or annual charge in exchange for products or services. Customers can renew their subscriptions after a specific amount of time. This concept allows the business to use its client relationships to generate a consistent source of cash.

The business can retain its customers for future sales and the customers have the convenience of automatically repurchasing the products or services they know they might need on a timely basis. Subscription business models basically focus on how money is generated such that a single client pays periodic payments for extended access to an item or service rather than a huge upfront one-time charge.

Related Posts