The electronic payment system aka digital payment has been rapidly growing in the last decade.

Specifically, during the pandemic, the time when any kind of physical exchange was restricted, consumers drastically adapted to contactless payments. This mass adoption of digital payment continued to grow after the pandemic as well, considering the convenience that it brought with it in addition to safety.

Here is the 2021 statistics from Bank Negara Malaysia– The country’s central bank. The bank in its annual report stated ” Digitalisation of financial services intensified in early 2020 and has continued to accelerate. In 2021, online banking transactions grew by 41.5% while e-wallet transactions increased by 74.4% compared to the previous year.”

How was it before 2021? Well, there was a gradual adoption of e-payment system but, wasn’t significant or drastic as it was in 2020 and 2021, which may be due to tech illiteracy or perhaps skepticism. So, 2021 was the year that marked the turning point for e-payment as the growth was double compared to the previous years.

Though the public opted for cashless payments in the pandemic years out of compulsion, the years after that, still saw a surge in the usage of cashless payments which is entirely because of the ease and security it offered to the consumers. The year 2023 marked a significant year in the fintech era for it has been recorded that many 1.8 million SMEs, (emerging as well as existing) have entrusted their payment operations to many online payment platforms, paving way for more digital payment adoption.

From internalizing e-payments, Malaysia has now grown to the stage of introducing cross-border payments which is a major move towards financial inclusion. Payment Network Malaysia has been ‘bridging borders and boosting business’ through cross-border collaborations with China, Hong Kong, Mangolia, South Korea & Thailand, taking the digital payment market in Malaysia to a new level. This is evident enough for the unimaginable growth curve that the country would be witnessing in digital payment market.

The Digital Grant 2023 passed by the Government of Malaysia also says a lot about the future of digital payment market. Ever since the government came forward to fund the businesses that opt for digital tools, a barrier of doubts has been lifted, encouraging all the businesses including start-ups to confidently invest in digital tools which might in turn boost digital economy of the country.

Considering the pace of e-payment adoption at the moment, a decade from now, Malaysia is about to see a historic growth that might as well surpass the already well-doing countries in e-payment.

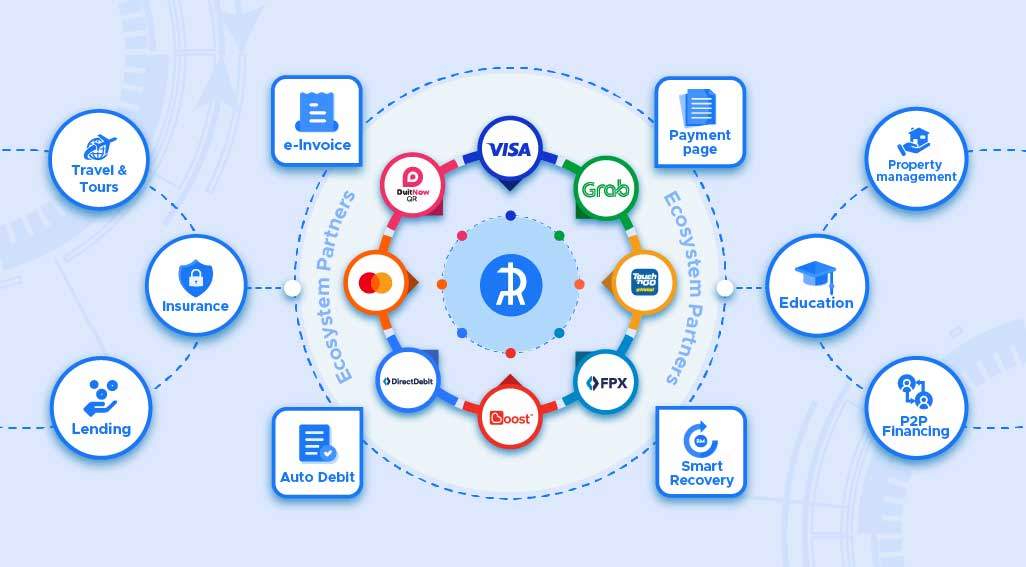

RinggitPay, being an online payment platform that has onboarded 300 merchants in the 2023, forecasts greatest growth in Malaysia’s digital payment market in the coming years.

Related Posts